As a certified public accountant (CPA), you know that tax season is a busy time. It’s that time of year again. The time for accountants to pull out their hair and stress about the impending tax season. Of course, there are always ways to make the process a little bit easier. Here are some tips to help you survive the most taxing time of year:

Stock up on supplies.

One of the most important things to remember when preparing for tax season is to have plenty of ink, paper, tax return folders, and pens on hand! This way, you won’t have to waste time running out to the store every time you need to file a return or print out a copy of a client’s tax documents.

Outline a timeline

The first step in surviving the busy season is creating a timeline. This will help you stay organized and ensure that no deadlines are missed. Make sure to include important dates such as when returns are due, when estimated taxes are due, and when tax payments are due.

Create a filing system.

A good filing system is key to finding documents you need when preparing clients’ tax returns. You’ll want to develop a system that is easy to use and makes sense to you. Having a system that is easy to use will help you to stay organized and efficient.

Get familiar with the software.

As a CPA, there’s a good chance you’re using tax software to help you prepare individual and business tax returns. While tax software is a great tool, it’s important to understand how to use it before you start working on returns.

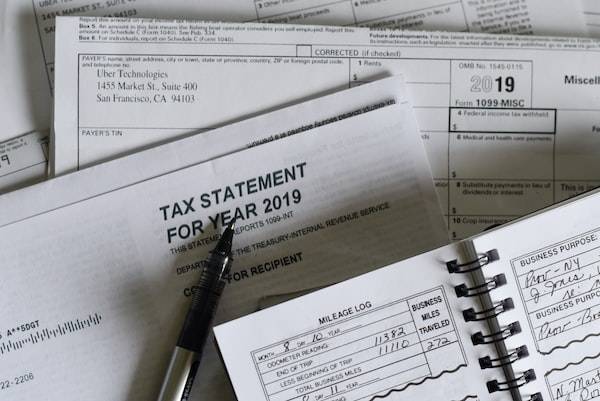

Gather your paperwork

Gathering your paperwork is an essential part of filing your clients’ tax returns. You’ll need all of your W-2s, 1099s, and other documentation to ensure that your returns are filed accurately. Once you have your paperwork organized, you can start preparing your clients’ returns. If you’re not sure how to prepare a particular form, there’s plenty of information available online or from your tax preparer.

Stay organized.

As a CPA, one of the best ways to survive tax season is to stay organized. This will help you keep track of all the paperwork and deadlines associated with client tax filings. It will also help you avoid stress and anxiety.

Double check relevant deadlines.

CPAs should also be aware of the various tax deadlines that apply to them and their clients. The most important tax deadlines are:

- January 15th – deadline for filing Form 1040 and paying any tax owed

- April 15th – deadline for filing Form 1040 and paying any tax owed, as well as for filing any required tax extensions

- October 15th – deadline for filing any required tax extensions

Research any new tax laws.

CPAs should also be familiar with the new tax laws that went into effect this year. These new tax laws may impact how CPAs file their clients’ taxes. New tax laws might include changes to the tax rates and the tax brackets, additions or removals of certain dedcutions or credits.

Take breaks.

This time of year can be very demanding, both physically and mentally. It’s important to take some time for yourself to relax and rejuvenate. It’s important to take a break during the busy season. Get up and walk around every hour or so to get your blood flowing. Take a break to eat lunch and get some fresh air. And, most importantly, make sure you get a good night’s sleep.

As all CPAs know, tax season is an extremely busy time of year. However, with careful planning and organization, CPAs can make the most of tax season and ensure that their clients’ taxes are filed correctly and on time.